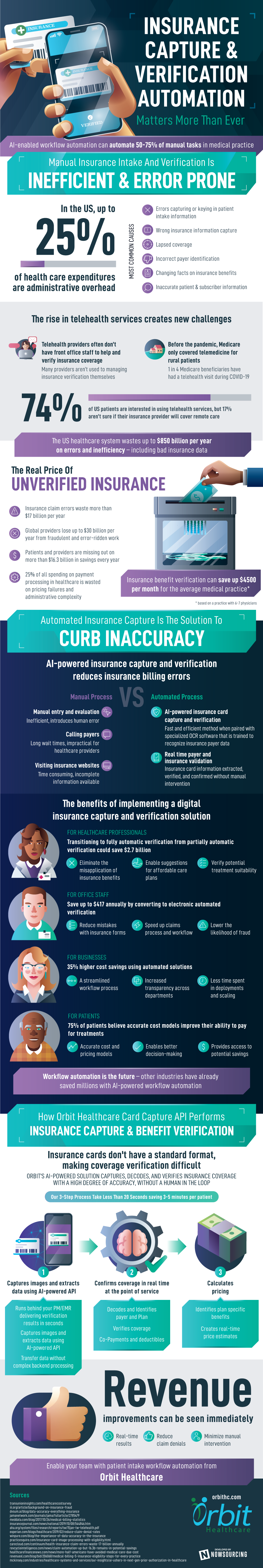

Insurance Capture & Verification Automation Matters More Than Ever

Insurance Card Scan

The world of insurance inaccuracy is currently an error prone world, but it doesn’t have to stay that way. Join the growing cliental of disruptive innovation of the insurance card scan , OCR and verification. This technology makes life easier for the end patient, as well as the medical office staff, all while providing a more efficient and accurate form of real time health insurance card OCR and real time insurance verification. Medical, Rx Prescription, Dental and vision insurance card OCR has taken a long time to master, its time has come. Learn more about the insurance card scan industry and how to benefit from this technology and automation in the infographic below:

The US healthcare system wastes up to $850 billion per year on errors and inefficiency – including bad insurance data

Insurance Inaccuracy Is On The Rise

- Nearly 20% of all health insurance information is inaccurate

- Most Common Causes

- Clerical errors or accidents

- Incorrect patient identities

- Padding and inflating claims

- Inaccurate medical treatment costs

- Changing facts on insurance applications

- Submitting false claims for damages and injuries

- Fake or staged physical accidents

- Most Common Causes

- The rise in telehealth services creates new confusion

- 74% of US patients are interested in using telehealth services

- 17% want to try telehealth but aren’t sure if their insurance provider will cover remote care

- Before the pandemic, Medicare only covered telemedicine for rural patients

- 1 in 4 Medicare beneficiaries have had a telehealth visit during COVID-19

- Telehealth providers often don’t have front office staff to help answer questions and verify insurance coverage

- Many providers aren’t used to managing insurance verification themselves

- 74% of US patients are interested in using telehealth services

Fraudulent health insurance data costs Americans up to $300 billion per year

- The Real Price Of Unverified Insurance

- Insurance owners

- Health insurance owners are missing out on more than $16.3 billion in savings every year

- Roughly 78% of Americans avoid going to the hospital for fear of costs, even despite serious medical conditions

- Insurance providers

- Insurance claim errors waste more than $17 billion per year

- Global providers lose up to $30 billion per year from fraudulent and error-ridden work

- Healthcare organizations

- Inaccurate claim payments cost healthcare companies roughly $1.5 billion in needless expenses

- 25% of all healthcare spending on processing payments is wasted on pricing failure and administrative complexity

- Insurance owners

Insurance benefit verification can save up $4500 per month for the average medical practice

Insurance Verification Is The Solution To Inaccuracy

- Methods Of Insurance Verification

- Manual entry and evaluation: Often the most flawed method because of human error

- Visiting insurance websites: Specific procedures and treatments are likely not listed on site

- Calling payers: Extremely long wait times are not feasible for healthcare workers

- Insurance OCR software: Extracts text data from insurance card using machine learning

- AI-powered insurance verification: Automatically extracts and verifies insurance coverages from card images

- The Benefits Of Digital Insurance Verification

- For patients

- 75% of patients believe accurate cost models improve their ability to pay for treatments

- Accurate cost and pricing models

- Enables better decision-making

- Provides access to potential savings

- 75% of patients believe accurate cost models improve their ability to pay for treatments

- For businesses

- 35% higher cost savings using automated solutions

- A streamlined deployment process

- Increased transparency across departments

- Less time spent in multi-server deployments

- 35% higher cost savings using automated solutions

- For office staff

- Save up to $417 annually by converting to electronic authorization verification

- Reduce mistakes with insurance forms

- Speed up claims process and workflow

- Lower the likelihood of fraud

- Save up to $417 annually by converting to electronic authorization verification

- For healthcare professionals

- Transitioning to fully automatic verification from partially automatic verification could save $2.7 billion

- Eliminate the misapplication of insurance benefits

- Enable suggestions for affordable care plans

- Verify potential treatment suitability

- Transitioning to fully automatic verification from partially automatic verification could save $2.7 billion

- For patients

Insurance OCR is the future – the US auto insurance industry has already saved more than $128 million through careful data checks

How Orbit Healthcare Performs Insurance Benefit Verification

- Orbit Healthcare connects all touchpoints of insurance OCR

- RestAPI extracts key data using AI and machine learning

- Generates results and accuracy predictions in real-time

- Saves healthcare professionals up to 11 hours of wasted time per month

- Resolves the challenges of patient intake

- Insurance eligibility with prior authorization

- Document capture, claims, and payment processing

- Transfer data without complex backend processing

- Thru our AI image capture , decode, and real-time benefit verification process we are able to achieve 92% success rate (according to a study of a nationwide payer across many stores)

- Our 3-step process

- Collects data using AI-powered API

- Runs at low latency and high concurrency

- Captures card images

- Photo ID

- Demographic data

- Insurance info

- Decodes and verifies insurance benefits

- Confirms coverage

- Validation of coverage

- Authorization and referrals

- Co-payments and insurance

- Calculate pricing

- Identified payer and claimant

- Create real-time price estimates

- Informs patients prior to treatment

- Collects data using AI-powered API

- Benefits that can be seen immediately

- Real time results

- Minimal disruptions

- Eliminating manual labor

Protect patients. Equip providers. Enable your healthcare team with Orbit Healthcare.

OrbitHC.com Sources

- http://transunioninsights.com/healthcarecostsurvey/

- https://revcycleintelligence.com/news/claim-automation-up-but-16.3b-remains-in-potential-savings

- https://www.practicesquire.com/insurance-card-image-processing-with-eligibility.html

- https://www.healthcarefinancenews.com/news/more-half-americans-have-avoided-medical-care-due-cost

- https://www.insurancejournal.com/news/national/2019/10/08/544846.htm

- https://dvsum.ai/blog/data-accuracy-everything-insurance

- https://www.revenuexl.com/blog/bid/206068/medical-billing-5-insurance-eligibility-steps-for-every-practice

- https://www.carecloud.com/continuum/health-insurance-claim-errors-waste-17-billion-annually

- https://www.iii.org/article/background-on-insurance-fraud

- https://revcycleintelligence.com/news/claim-automation-up-but-16.3b-remains-in-potential-savings

- https://winpure.com/blog/the-importance-of-data-accuracy-in-the-insurance

- https://www.iii.org/article/background-on-insurance-fraud

- https://www.meddata.com/blog/2017/10/26/medical-billing-statistics

- https://www.aha.org/system/files/research/reports/tw/15jan-tw-telehealth.pdf