AI-Powered Insurance Card Reader API

Microsoft Customer Stories: Orbit Healthcare increases scalability with Azure migration

Accurately capturing and verifying insurance information is one of the most critical components of every healthcare provider’s patient intake process. Many providers use a manual entry process or rely on basic optical character recognition (OCR) systems for this crucial step.

Capture Card through AI Powered Rest API/SDK

Image capture made simple using RestAPI/SDK that comes with two different ways of capturing the image. In both methods the file format checker and byte level signature security checks performed for security.

Client side image crop method uses Azure CDN URL that uses the computing power of end user device and runs on client side to capture, crop the target card and renders reduce size and optimized image Server side image crop method offers RestAPI that can take raw image and return optimized image after running thru AI model in back end.

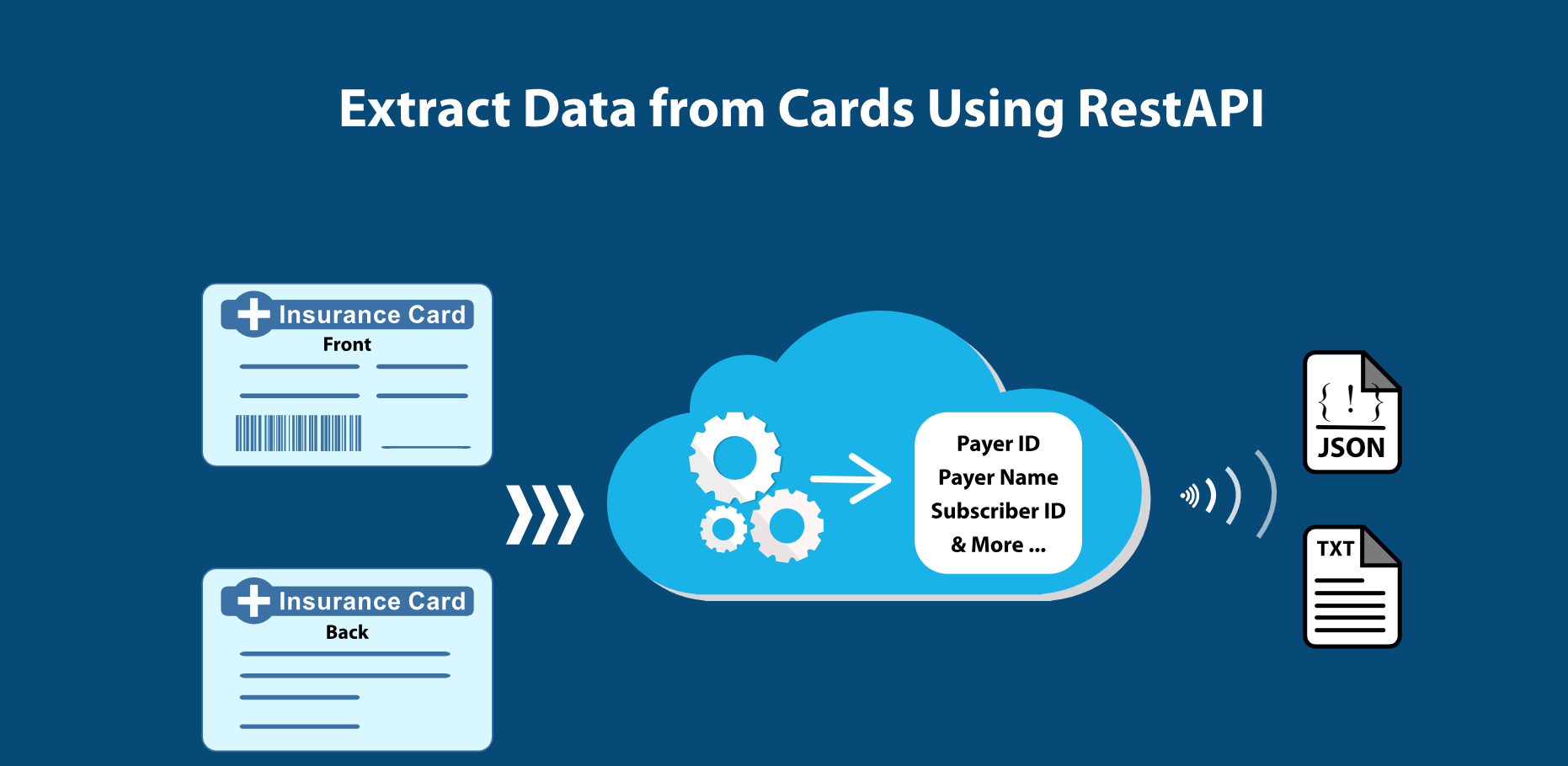

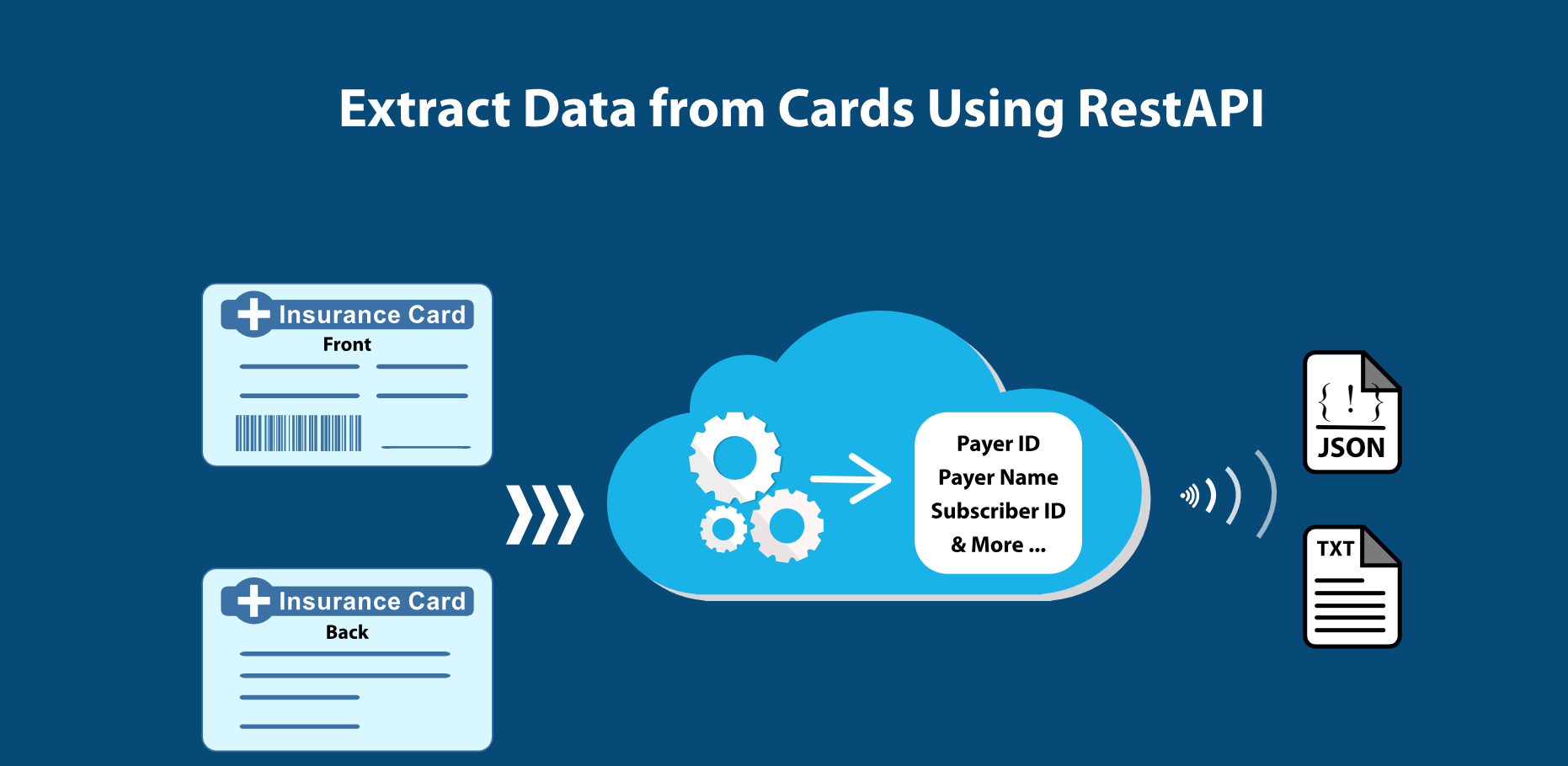

Extract Data from Cards Using RestAPI

Using RestAPI from your application pass the front and back of the insurance card to receive the critical data elements including Subscriber ID, Group ID, Insurance Payer Name, Payer ID from Insurance cards in real time.

Extract Data from Cards Using RestAPI

Using RestAPI from your application pass the front and back of the insurance card to receive the critical data elements including Subscriber ID, Group ID, Insurance Payer Name, Payer ID from Insurance cards in real time.

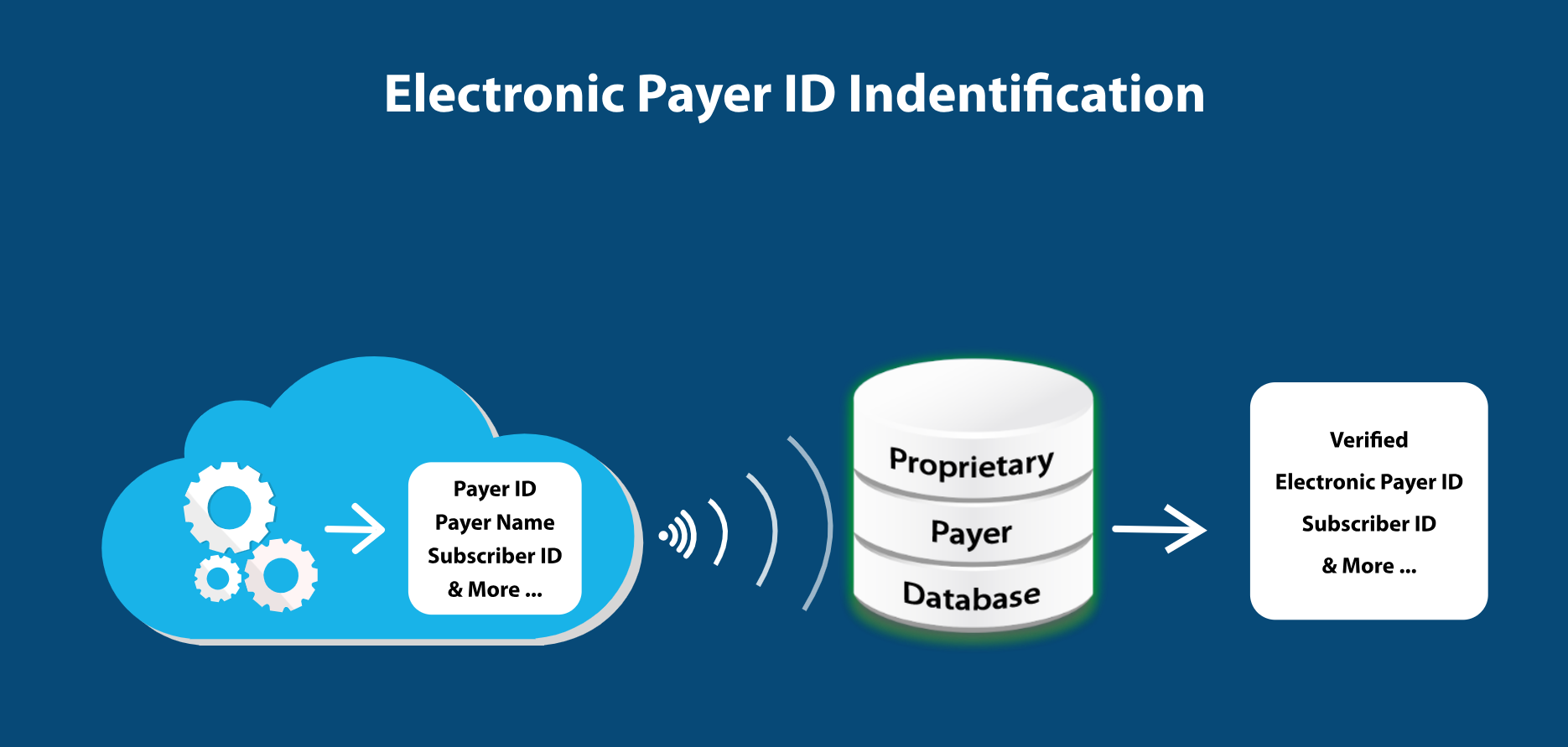

Electronic Payer ID Identification

Electronic Payer ID is not available on some Insurance cards. PracticeSquire team curated proprietary payer database and combination of AI classification algorithms identify the Electronic Insurance Payer ID.

This step additional step performed as part of the RestAPI Card OCR request to provide additional information that many OCR solutions cannot provide.

Real Time Eligibility Verification Using RestAPI

After detecting the insurance data elements from card, the same RestAPI can also be used for validating the insurance coverage and benefits in realtime.

Insurance benefit validation RestAPI may also be as stand alone without passign the insurance card images.

Real Time Eligibility Verification Using RestAPI

After detecting the insurance data elements from card, the same RestAPI can also be used for validating the insurance coverage and benefits in realtime.

Insurance benefit validation RestAPI may also be as stand alone without passign the insurance card images.

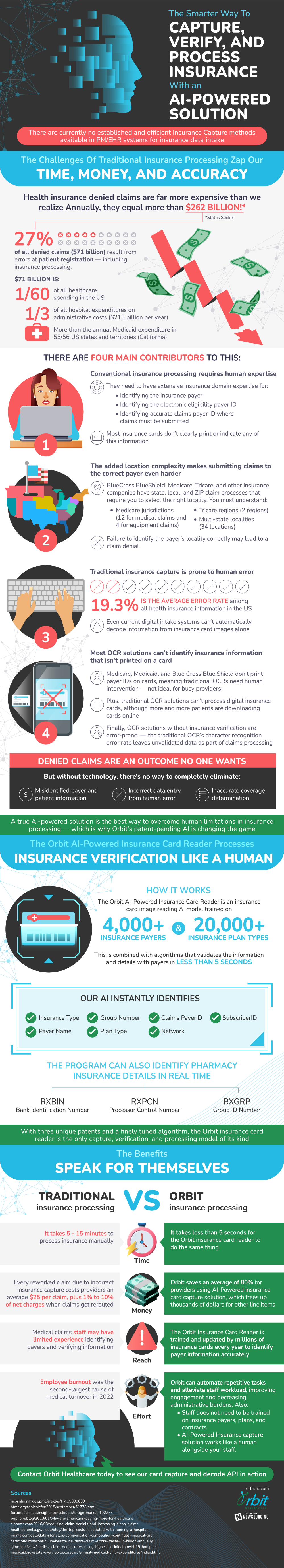

The Smarter Way to Capture, Verify, and Process Insurance with an AI-Powered Solution

There are currently NO established and efficient Insurance Capture methods available in PM/EHR systems for insurance data intake

The Challenges Of Traditional Insurance Processing Zap Our Time, Money, And Accuracy

- Health insurance denied claims are far more expensive than we realize Annually, they equal more than $262 billion!* *Status Seeker

- 27% of all denied claims ($71 billion) result from errors at patient registration — including insurance processing

- $71 billion is:

- 1/60 of all healthcare spending in the US

- 1/3 of all hospital expenditures on administrative costs ($215 billion per year)

- More than the annual Medicaid expenditure in 55/56 US states and territories (California)

- There are four main contributors to this:

- $71 billion is:

- 27% of all denied claims ($71 billion) result from errors at patient registration — including insurance processing

- Conventional insurance processing requires human experts

- They need to have expensive insurance domain expertise for:

- Identifying the insurance payer

- Identifying the electronic eligibility payer ID

- Identifying accurate claims payer ID where claims must be submitted

- Most insurance cards don’t clearly print or indicate any of this information

- The added location complexity makes submitting claims to the correct payer even harder

- BlueCross BlueShield, Medicare, Tricare, and other insurance companies have state, local, and ZIP claim processes that require you to select the right locality

- You must understand:

- Medicare jurisdictions (12 for medical claims and 4 for equipment claims)

- Tricare regions (2 regions)

- Multi-state localities (34 locations)

- Failure to identify the payer’s locality correctly may lead to a claim denial.

- Traditional insurance capture is prone to human error

- 3% is the average error rate among all health insurance information in the US

- Even current digital intake systems can’t automatically decode information from insurance card images alone

- Most OCR solutions can’t identify insurance information that isn’t printed on a card

- Medicare, Medicaid, and Blue Cross Blue Shield don’t print payer IDs on cards, meaning traditional OCRs need human intervention — not ideal for busy providers

- Plus, traditional OCR solutions can’t process digital insurance cards, although more and more patients are downloading cards online

- Finally, OCR solutions without insurance verification are error-prone

- The traditional OCR’s character recognition error rate leaves unvalidated data as part of claims processing

- Denied claims are an outcome no one wants

- But without technology, there’s no way to completely eliminate:

- Misidentified payer and patient information

- Incorrect data entry from human error

- Inaccurate coverage determination

- But without technology, there’s no way to completely eliminate:

A true AI-powered OCR solution is the best way to overcome human limitations in insurance processing — which is why Orbit’s patent-pending AI is changing the game The Orbit AI-Powered Insurance Card Reader Decodes Payers, Records Plans, And Processes Insurance Verification Like A Human

- The Orbit AI-Powered Insurance Card Reader is an insurance card image reading AI model trained on 4,000+ insurance payers and 20,000+ insurance plan types

- This is combined with algorithms that validate the information and verify details with payers in less than 5 seconds

- Our AI instantly identifies:

- Insurance Type

- Payer Name

- Claims PayerID

- Plan Type

- SubscriberID

- Group Number

- Network

- The program can identify pharmacy insurance details in real time

- RXBIN: Bank Identification Number

- RXPCN: Processor Control Number

- RXGRP: Group ID Number

With three unique patents and a finely tuned algorithm, the Orbit insurance card reader is the only capture, verification, and processing model of its kind And The Benefits Speak For Themselves

- Time

- It takes 5 – 15 minutes to process insurance manually

- It takes less than 5 seconds for the Orbit insurance card reader to do the same thing

- Money

- Every reworked claim due to incorrect insurance capture costs providers an average $25 per claim, plus 1% to 10% of net charges when claims get rerouted

- Orbit saves an average of 80% for providers using AI-Powered insurance card capture solution, which frees up thousands of dollars for other line items

- Reach

- Medical claims staff may have limited experience identifying payers and verifying information

- The Orbit Insurance Card Reader is trained and updated by millions of insurance cards every year.

- Effort

- Employee burnout was the second-largest cause of medical turnover in 2022

- With Orbit, you can automate repetitive tasks and alleviate staff workload, improving engagement and decreasing administrative burdens

- Staff does not need to be trained on insurance payers, plans, and contracts

- AI-Powered Insurance capture solution works like a human alongside your staff

Contact Orbit Healthcare today to see our card capture and decode API in action.

Sources

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5009899/

https://www.carecloud.com/continuum/health-insurance-claim-errors-waste-17-billion-annually/

https://www.hfma.org/topics/hfm/2018/september/61778.html

https://www.ajmc.com/view/medical-claim-denial-rates-rising-highest-in-initial-covid-19-hotspots

https://www.mgma.com/data/data-stories/as-compensation-competition-continues,-medical-gro

https://www.ciproms.com/2016/08/reducing-claim-denials-and-increasing-clean-claims/

https://www.pgpf.org/blog/2023/01/why-are-americans-paying-more-for-healthcare

https://healthcaremba.gwu.edu/blog/the-top-costs-associated-with-running-a-hospital/

https://www.medicaid.gov/state-overviews/scorecard/annual-medicaid-chip-expenditures/index.html